Boost your growth with the credit card.

Access higher credit limits and spending power with combined advanced spend management tools and smarter card controls.

By signing up, you're confirming that you agree with our Terms and Conditions.

Access credit via credit cards

Corporate credit cards for startups,

mid-size businesses,

and enterprises.

Explore DemoAccess high credit limit

Get credit limit tailored to your business's needs, determined by financial metrics such as revenue, cashflow, etc.

Issue corporate cards

- Instantly issue corporate cards (physical and virtual) to your team to start spending immediately.

- Depending on your chosen account type during signup, cards issued can serve as debit cards, or credit cards, or both.

Equipped with spend management tools

Evea cards are directly tied to financial management tools, enabling you to maintain control as your business scale.

Earn rewards as you spend

Earn up to 5x back on your purchases and redeem for cash back, statement credits, etc.

Minimal cash balance requirement

Eligibility starts with an average cash balance of N3M in your bank account to access a credit card account.

Accelerate your growth with a credit card account.

Boost your cashflow

- Become eligible for a credit card account by maintaining an average cash balance of N3M in your bank account.

- Get access to high revolving credit limits tailored to your business's needs, determined by financial metrics such as revenue, cashflow, etc.

- Begin spending right away with both virtual and physical cards.

Experience a seamless onboarding process.

Open a credit card account in minutes

- Simply share details about your business and upload the necessary documents to begin the underwriting process.

Undergo modern (ML) underwriting process

- Leveraging comprehensive real-time financial data and metrics to underwrite your business so as to issue credit limits tailored to your business's needs.

Set up your team effortlessly

- In mere moments, create your Evea Card which is equipped with spend management capabilities, allowing you to setup spending restrictions & controls that help enforece your expense policy.

Open a credit card account in minutes

Undergo modern (ML) underwriting process

Set up your team effortlessly

All in 5 min max

Ensure every spend stays within budget.

Scale securely with robust spend management capabilities

Evea cards come with built-in spend & expense management, ensuring that your spending stays on track. After all, a card lacking controls can lead to chaos.

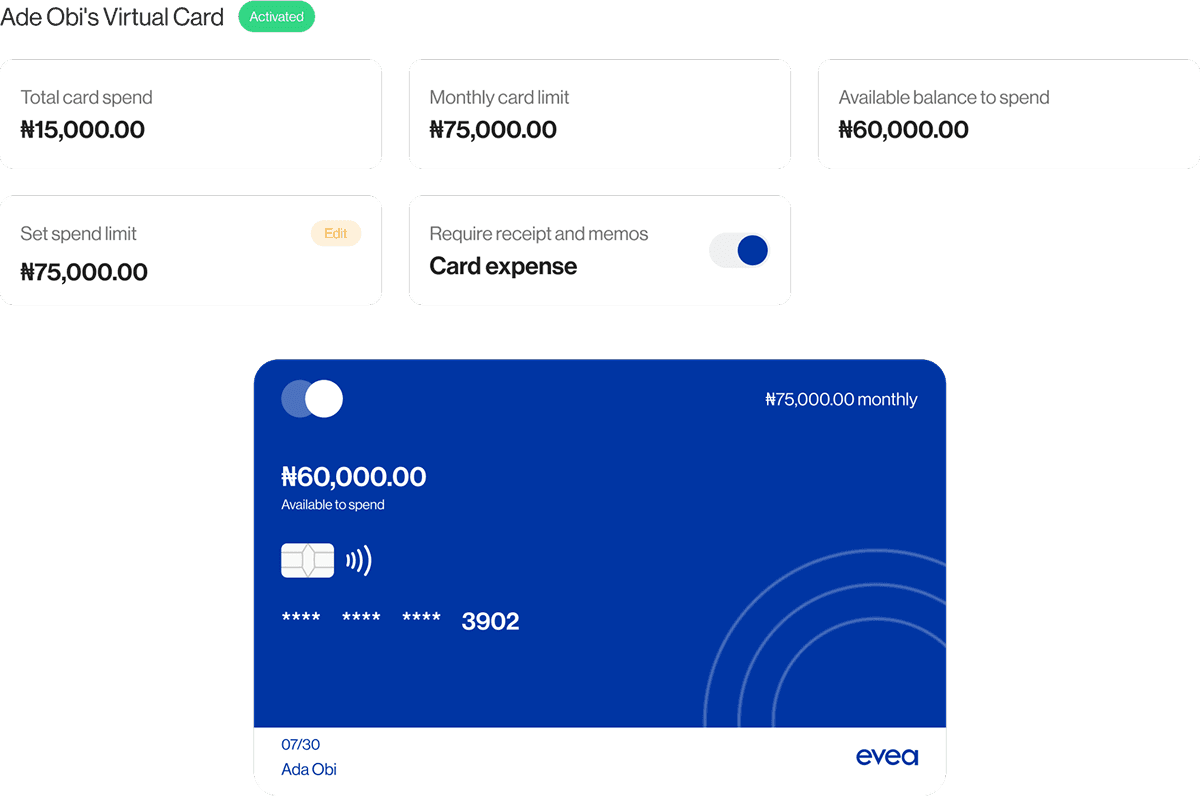

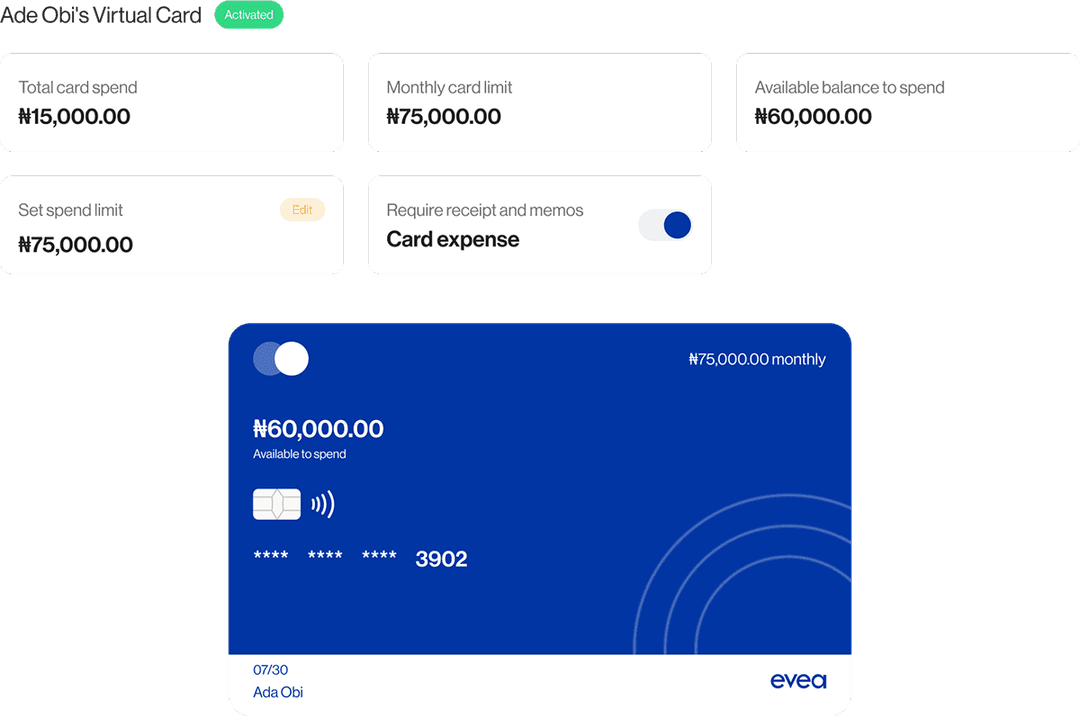

Custom limits and spend controls

Exercise precise control over cards at every level, whether it's limiting spending to particular vendors, setting card limits or spending limits, or blocking unwanted expense categories and specific merchants.

Cards for your team

Empower your team by issuing as many cards as necessary.

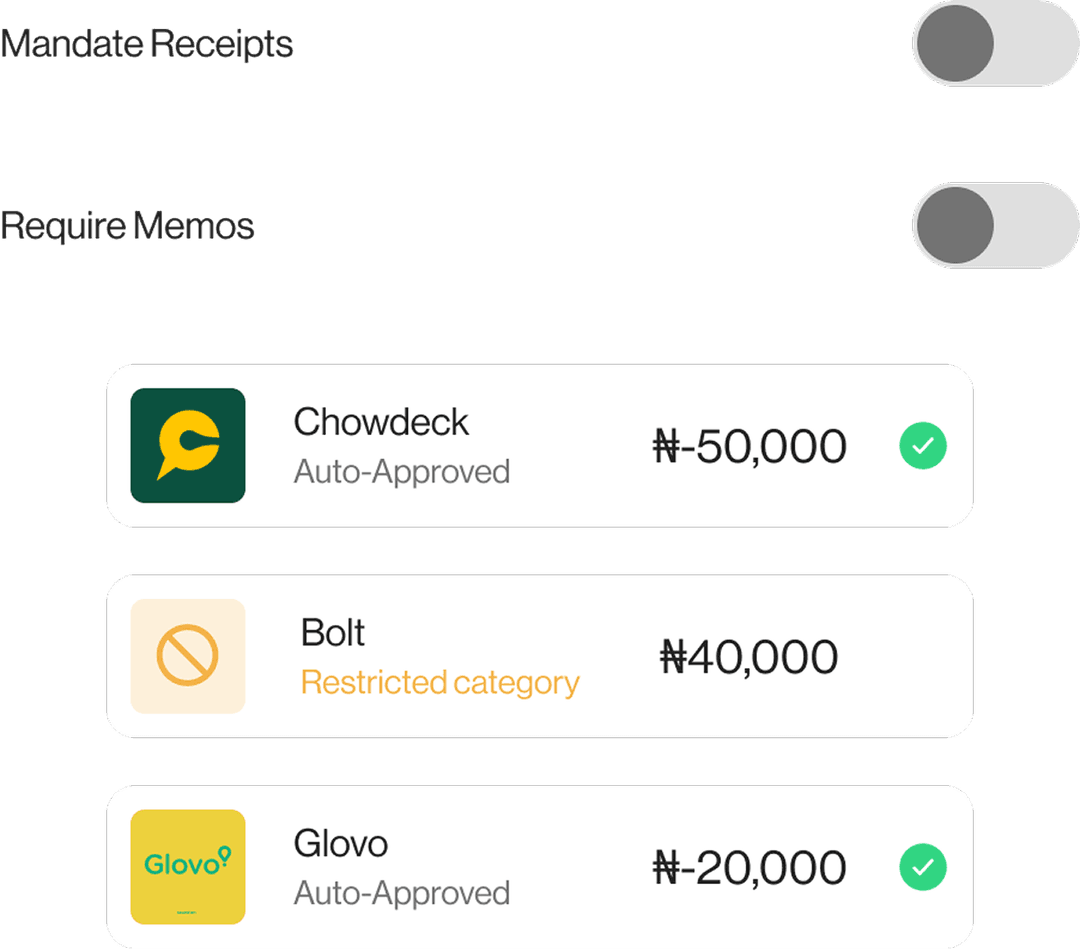

Implementing compliance

Set up policies such as mandating receipts and memos for all or specific expense types and amounts, thereby streamlining your expense tracking process.

Custom limits and spend controls

Exercise precise control over cards at every level, whether it's limiting spending to particular vendors, setting card limits or spending limits, or blocking unwanted expense categories and specific merchants.

Cards for your team

Empower your team by issuing as many cards as necessary.

Implementing compliance

Set up policies such as mandating receipts and memos for all or specific expense types and amounts, thereby streamlining your expense tracking process.

Discover the myriad of possibilities with Evea Corporate Cards.

Experience the flexibility of Evea Corporate Cards as we showcase the myriad of ways our customers leverage them for their needs.

Monitor advertising expense.

Considering launching ad campaigns on Facebook or LinkedIn? Create a vendor-virtual corporate card exclusively for spending with those specific merchants, enabling real-time tracking of company expenses.

Empower employees with controlled spending for office needs.

Provide your team members with cards featuring precise spending limits and controls, facilitating their procurement of essential materials and office supplies while ensuring adherence to expense policies.

Cover business-related travel expenses for employees.

Arrange flights and cover team and client meals effortlessly using designated Evea corporate cards allocated to specific budgets or teams.

Restrict card access to senior executives

For some businesses, limiting corporate card access to senior executives or owners is preferred. Evea corporate cards can be effortlessly designated solely to senior-level employees.

Streamline you procurement spending

Allocate Evea cards to designated budgets, vendors or expense categories, enhancing the efficiency of your procurement and accounts payable procedures.

Corporate Cards

Explore the multitude of possibilities with Evea Corporate Cards.

Discover the versatility of Evea Corporate Cards as we have highlighted the diverse ways our customers utilize them to meet their requirements.

Evea's financial OS.

The corporate credit card is just a single component of the Evea's financial stack.

Explore DemoSpend Management

Control spend before it happens.

Budgets simplify the process of planning and allocating spend.

Accounting automation

Close the books in record time.

Expense

Track and manage expenses with instantly categorized transactions.

Transaction details

₦24,540.00 + ₦450.00 (fees) • 0 Reward Points

Card number

•••• •••• •••• 2345

Reference number

429687986783

Transaction date

Feb 09 2024, 8:00 pm

Accounts payable (AP)

Handle vendor payments with auto-filled invoices configuring admin approvals, and overseeing bills - all through a dedicated Accounts Payable (AP) account.

Bank account

Setup a business account within minutes, without requiring a minimum balance or references.

Organise your cash with multiple operating accounts (sub-accounts)

Open multi-currency IBAN accounts for your business within minutes, and instantly send & receive payments in up to 25 currencies from anywhere across the globe

Frequently asked questions

Answers to common questions about Evea Business Accounts.

Any registered business operating in Africa is eligible, including startups, SMEs, and enterprises.

Eligibility is subject to our underwriting review, which assesses your business financials, transaction history, and operational stability

Your credit limit is set using Evea’s underwriting model, which evaluates:

- Your business cash flow

- Bank statements and transaction patterns

- Revenue consistency

- Exisiting liabilities

- Business credit profile

Once approvedm credit limits can be automatically increased as your business grows and demonstrates strong repayment behavior.

Evea credit cards operate on a monthly billing cycle.

You are required to make repayment on or before your due date every month.

If you do not pay the full amount, an APR (interest) will apply to the remaining balance until it is cleared.

Evea charges:

- 3% on every transaction done using the credit card

- 0.5% interchange fee

There are no monthly subscription fees, hidden charges, or surprise deductions.

Late repayment may attract additional interest as stated in your credit agreement.

Once approvedm credit limits can be automatically increased as your business grows and demonstrates strong repayment behavior.

Yes. Responsible usage and timely repayments on your Evea credit card help build your business credit profile, increasing your eligibility for higher limits, AP Capital, and future financing opportunities

Discover the capabilities of Evea.

Attain the spending strength you desire along with the necessary controls today.