The ideal solution for managing your operating cash.

Get a business account that enables fast global payments and seamlessly integrates with the financial management software, surpassing traditional banking norms.

By signing up, you're confirming that you agree with our Terms and Conditions.

Evea banking

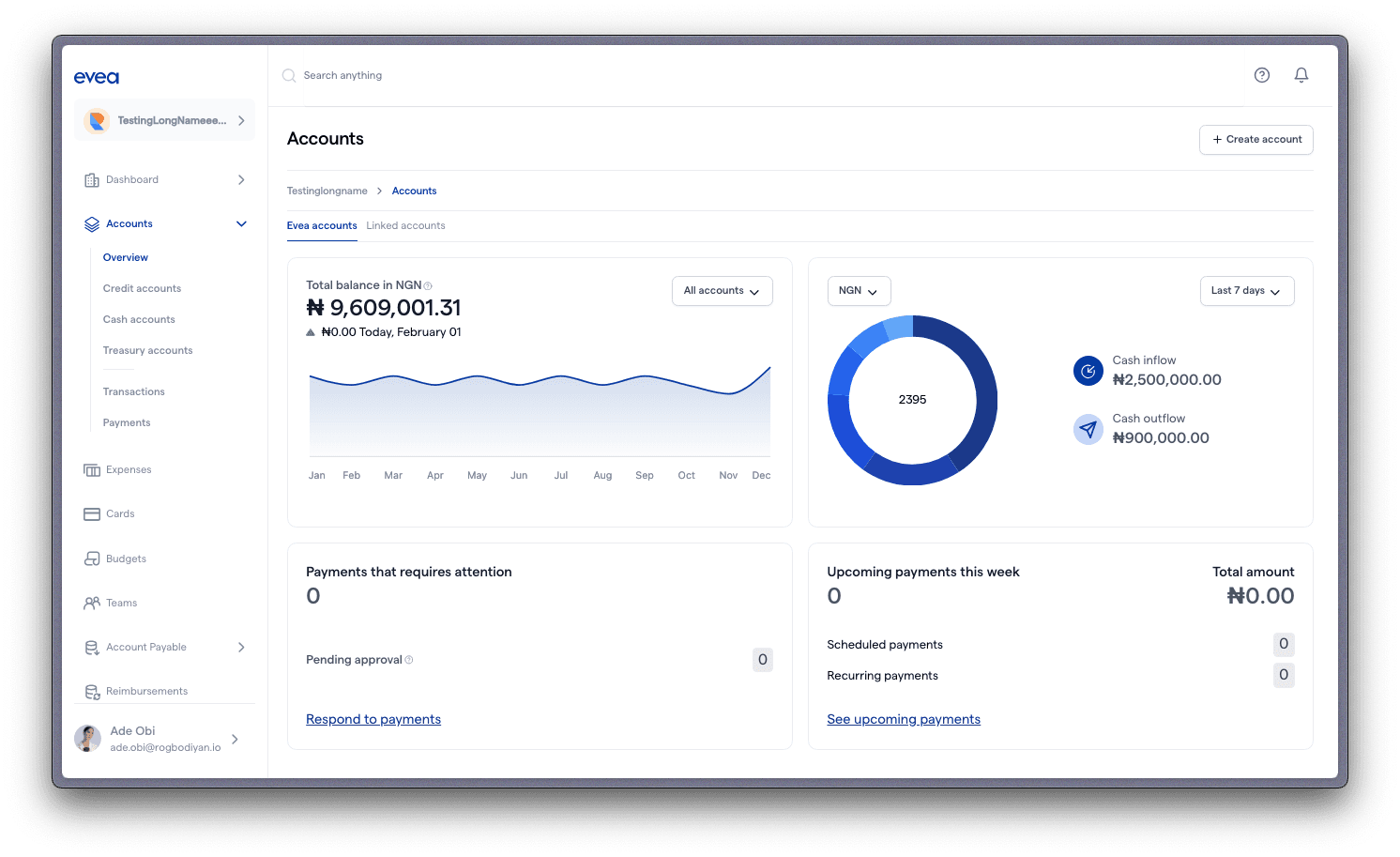

All you require for seamless banking experience.

Efficiency meets simplicity with Evea. The intuitive interface allows you to complete any banking task with just a few clicks, empowering you to focus on what matters most—growing your business.

Explore DemoSeamless payments

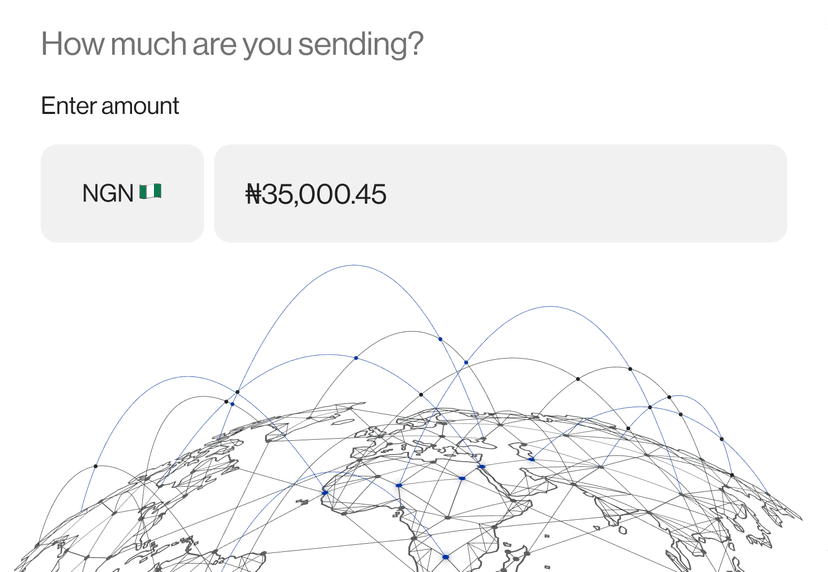

Send and receive money locally and globally in USD and other currencies via ACH, SWIFT, and wire transfers.

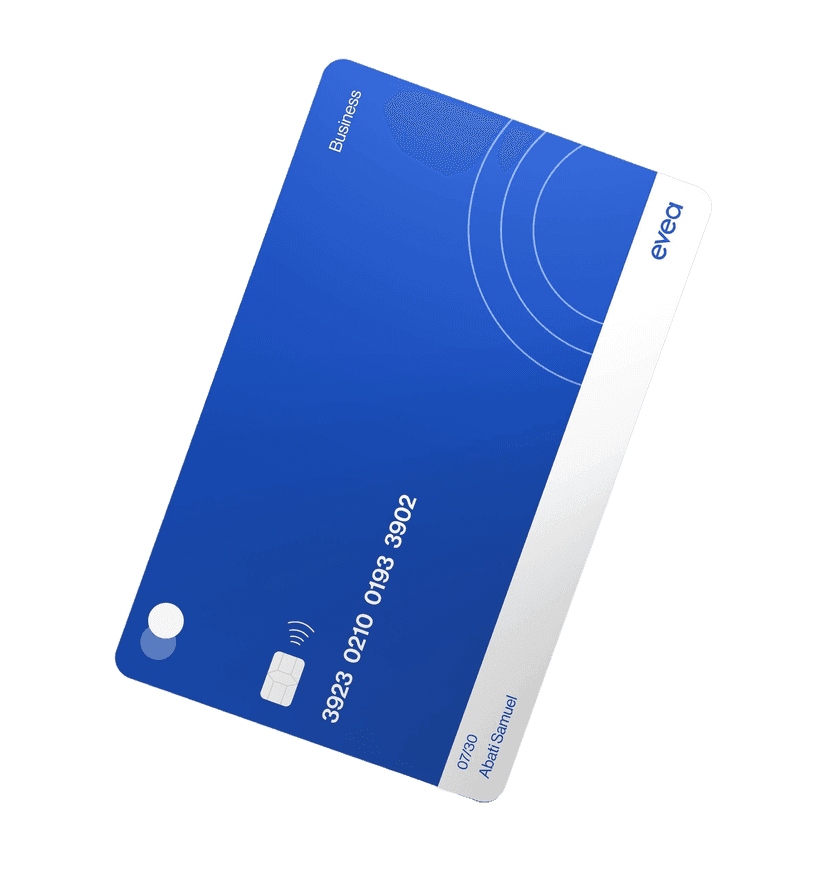

Corporate cards

Virtual and physical cards with a business credit line - repay from your Evea account, interest-free.

Custom account rules

Establish user-specific permissions and controls on every accounts.

Account Managers

Account Owner

Automated AP

Handle vendor payments with auto-filled invoices configuring admin approvals, and overseeing bills - all through a dedicated Accounts Payable (AP) account.

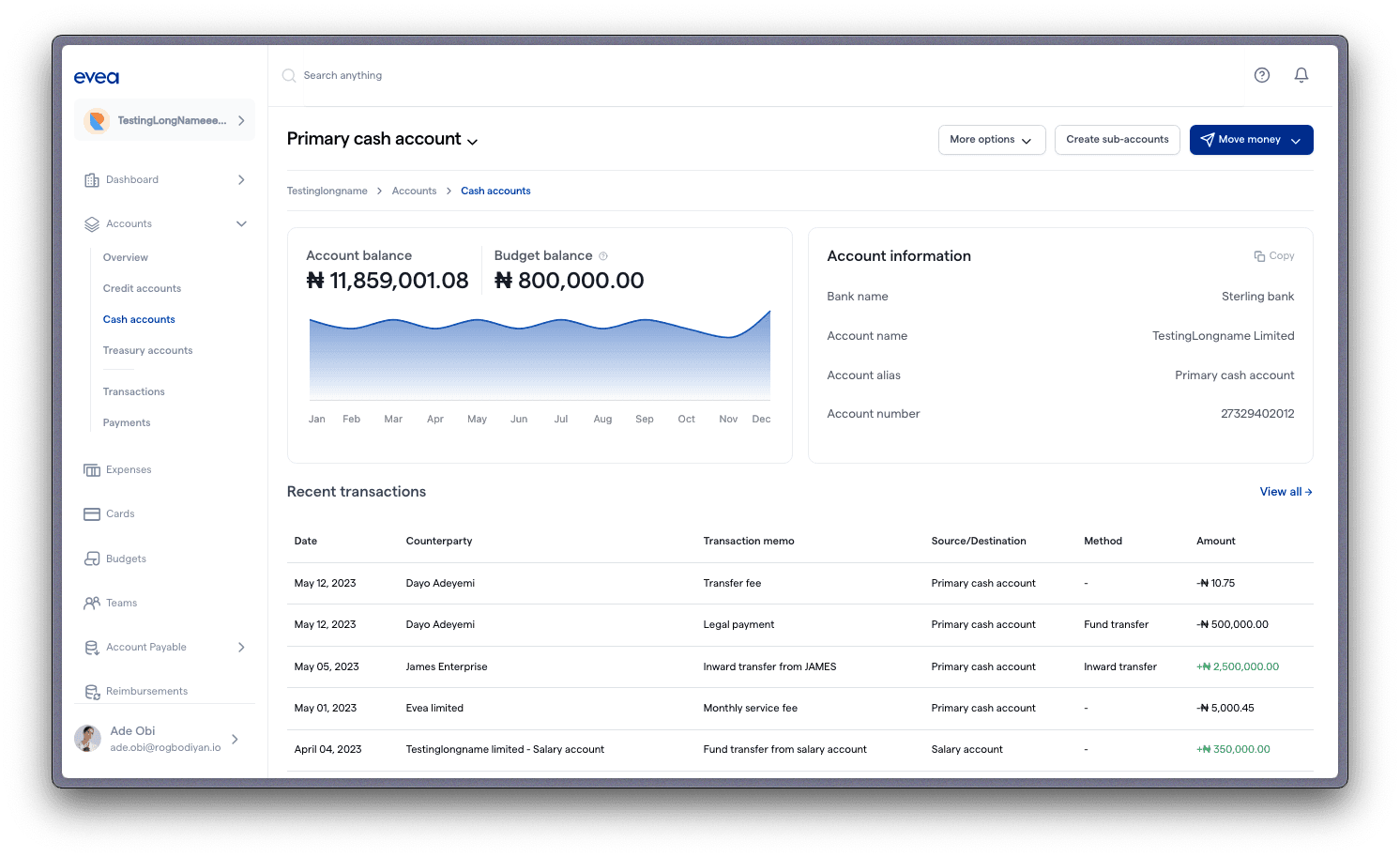

Bank account

Setup a business account within minutes, without requiring a minimum balance or references.

Organise your cash with multiple operating accounts (sub-accounts)

Open multi-currency IBAN accounts for your business within minutes, and instantly send & receive payments in up to 25 currencies from anywhere across the globe

Build a sturdy financial base.

Ready to utilize those investor funds, capital, business loan? Get a versatile account enabling you to save, spend, and grow your cash, all through a unified dashboard.

Banking at your pace

Fast Onboarding

Open your account in minutes - no minimum balances, no references.

Secure Funds

Your money is fully protected across our NDIC-insured partner banks.

Earn More

Put idle cash to work with 3.54% money market yield and same-day liquidity - move funds anytime.

Secure funds

Your funds are well secured and protected across our NDIC-Insured Partner Banks

Manage spending with advanced control measures

User-Level Permissions

Assign roles and manage who sees, approves, or acts on specific accounts - ensuring every team member only accesses what's relevant.

Transaction Approval

Set clear approval rules for payments - defined who can spend, who approves, and when oversight is required.

User-level permissions management

View 5+ other members

Send & receive payments.

With your IBAN account(s), you can receive payments in up to 25 currencies instantly from anywhere in the world

Flexible Transfers & Global Payments

Move money seamlessly - locally or globally

Global Payments

Set up one-time, scheduled or recurring transfers, and pay international vendors in their preferred currency with just a 1% FX fee and 0.5% transfer fee.

Flexible Fund Transfers

Your Funds. Fully Protected.

- Your deposits are NDIC-insured through our partner banks, and you can grow your idle funds by earning yield through our Treasury Money-Market fund portfolios.

Spend Management

Control spend before it happens.

Budgets simplify the process of planning and allocating spend.

Treasury

Generate returns on idles funds directly alongside your operational accounts.

Reimbursements

Reimburse employees in their local currency directly to their designated bank account

Accounts payable (AP)

Handle vendor payments with auto-filled invoices configuring admin approvals, and overseeing bills - all through a dedicated Accounts Payable (AP) account.

Corporate cards

- Access a business line of credit with the Evea Corporate Credit Card account and easily pay-off credit statements (i.e. the credit debt) seamlessly with an Evea business account to avoid interests.

- Depending on your chosen account type during signup, cards issued can serve as debit cards, or credit cards, or both.

What are customers saying?

This Financial OS is redefining how finance teams operate — it’s the connective tissue between data, decisions, and execution.

Michael Shadrack WalthaFounder/CEO, Wellat Markets IncThe automation and transparency this platform delivers are game-changing. It’s like having a CFO’s intuition built into software.

Jadesola LagokeCEO, Jadegate Nigeria LimitedFinally, a financial system that unifies forecasting, reporting, and scenario modeling in real time.

John OmaghomiFounder/CEO, SeamTrack LimitedIt bridges the gap between finance and operations better than anything I’ve seen in two decades of consulting.

Michael Shadrack WalthaFounder/CEO, Wellat Markets IncFrom cash flow to capital allocation, this OS provides the clarity executives have been craving.

Jadesola LagokeCEO, Jadegate Nigeria LimitedA must-have platform for any company serious about scaling with financial discipline and agility.

John OmaghomiFounder/CEO, SeamTrack Limited

Frequently asked questions

Answers to common questions about Evea Business Accounts.

No — Evea is not a bank. We are a financial technology company providing corporate credit cards, global business banking accounts, and advanced financial management tools for African businesses.

All banking services are offered through our licensed banking partners.

Your funds are safely held with our regulated banking partners, including Providus Bank.

Evea does not hold customer deposits directly — your money is secured in safeguarded accounts with these institutions.

Evea is built for businesses.

You can open an account if you are:

- A registered business (Limited Company, Limited Liability Partnership, or Business Name)

- A startup or SME or enterprise operating in Africa

- Able to provide standard KYC and business verification documents

To get started, you'll need:

- Business Registration Documents (CAC Certificate, Form CAC or status report)

- Valid ID for all directors/signatories (NIN slip, International Passport, or Driver’s License)

- Tax Identification Number (TIN)

- Proof of Address (utility bill or business address document)

Additional documentation may be required for credit account underwriting

Yes. Evea partners with licensed financial institutions that maintain strict regulatory capital requirements and deposit safeguards.

Customer funds are held in segregated accounts, meaning your money is secure even in extreme market conditions.

Additionally, Evea does NOT lend out customer deposits — eliminating traditional bank-run risk.

Open your account in minutes.

Optimize your operations with the business banking that is designed to elevate your performance.