Account Payable automation, Process your invoices instantly.

Optimize invoice management, eradicate manual data entry, and foster stronger vendor relationships by automating accounts payable with Evea, enhancing financial accuracy directly within your bank account.

By signing up, you're confirming that you agree with our Terms and Conditions.

Manage bills intelligently.

Manage bills with precision using automated software, eliminating manual tasks for more accurate payments.

Onboard your vendors

Easily onboard vendors by entering their email address; Evea sends a secure link to your vendor, for them to upload their payment details, eliminating manual data entry and errors.

Process your invoices instantly.

Send invoices to your dedicated AP inbox via email, or simply upload it, and let Evea auto-capture the details, reducing human errors. Bills are then organized by approval status and due date, helping you prioritize.

Automatically route to the right approvers.

Set up multi-level approval flows based on amount, vendor, employee role, and more; and Evea will automatically ensure the right people sign off every time.

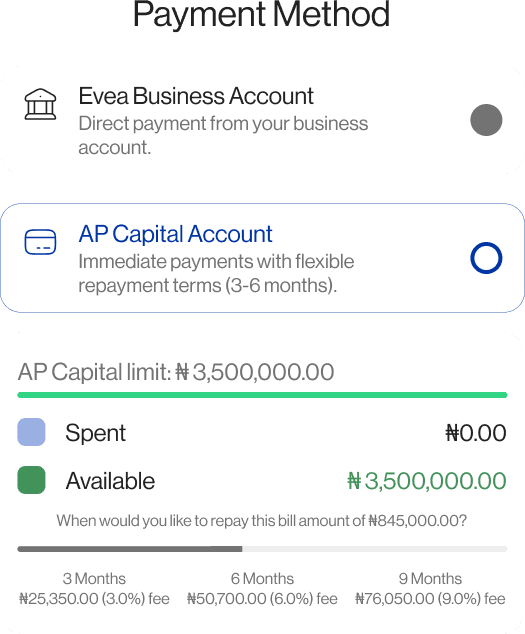

Choose your payment method.

Complete your bill payments using either your Evea business account or AP capital account. With AP Capital, businesses enjoy the flexibility of making immediate Evea-funded payments to vendors and repaying Evea over a period of 3 to 6 months. —— Only eligible Evea credit card account users are pre-approved for AP Capital.

Effortlessly sync with your ERP for bill reconciliation.

Simplify reconciliation and sync your bill, payment, and vendor information seamlessly with your ERP accounting systems to speed up the closing of your books..

Streamline your AP process.

Evea enhances Accounts Payable.

Automate invoice processing and payments for your business.

Pay vendors using various supported payment methods.

Evea automatically identifies duplicate invoices, safeguarding against overpayment or duplicate payments.

Automate reconcillation seamlessly from invoice to accounting system, eliminating manual tasks.

Safeguard against fraud payments by restricting payments to recognized vendors only - for only known vendors are allowed to send you bills.

Generate a transparent AP audit trail to spot potential fraud, errors and areas for process enhancement.

Consolidate banking, accounts payable, and T&E expenses management in a single platform.

Spend Management

Control spend before it happens.

Budgets simplify the process of planning and allocating spend.

Treasury

Generate returns on idles funds directly alongside your operational accounts.

Reimbursements

Reimburse employees in their local currency directly to their designated bank account

Accounts payable (AP)

Handle vendor payments with auto-filled invoices configuring admin approvals, and overseeing bills - all through a dedicated Accounts Payable (AP) account.

Corporate cards

- Access a business line of credit with the Evea Corporate Credit Card account and easily pay-off credit statements (i.e. the credit debt) seamlessly with an Evea business account to avoid interests.

- Depending on your chosen account type during signup, cards issued can serve as debit cards, or credit cards, or both.

Frequently asked questions

Answers to common questions about Evea Business Accounts.

AP Automation digitizes your invoice and vendor payments. Evea captures invoices, routes them for approval, and pays vendors — reducing manual work and errors.

Simply enter your vendor’s email in Evea — we send them a secure link where they can upload their payment information. This removes the need for manual vendor data entry and improves accuracy.

You can either forward invoices to your dedicated AP inbox via email or upload them directly to the platform. Evea then auto-captures invoice details (e.g., amount, vendor, due date), organizes bills by approval status, and highlights what needs to be paid.

Yes. You can configure multi-level approval workflows based on invoice amount, vendor, or the role of the person approving. This helps you maintain control and ensure proper checks before payments are made

There are two main payment methods to pay vendors:

- From your Evea Business Account — pay directly using your business cash.

- Using AP Capital Account — Evea can fund the invoice now, and you repay over 3–9 months. (Note: AP Capital is ONLY available to eligible Evea credit account customers.)

Evea automatically detects duplicate invoices to prevent overpayments. Additionally, you can restrict payments to only approved vendors in your Evea account, reducing the risk of fraud.

Yes. Evea integrates with your accounting software to automatically sync invoice, payment, and vendor data for easier reconciliation.

Absolutely. Every invoice, approval, and payment are tracked, giving you full transparency and compliance-ready records.

Finance or accounting team members with the right permissions. Role-based access ensures only authorized users can approve or make payments.

Discover the Evea Advantage

Unlock the power of Evea's modern banking platform and financial OS.